TotalEnergies has announced the signing of an agreement with Energetický a průmyslový holding, a.s. (EPH) for the acquisition of 50% of its flexible power generation platform (gas-fired and biomass power plants, batteries) in Western Europe (Italy, United Kingdom and Ireland, Netherlands, France), valued at €10.6 billion (enterprise value), i.e. a multiple of 7.6x 2026 EBITDA.

Under the agreement, EPH will receive the equivalent of €5.1 billion in TotalEnergies shares. 95.4 million TotalEnergies shares will be issued, based on a price equal to the volume-weighted average share price of the twenty trading sessions preceding November 16th (signing date), i.e. €53.94 per share, representing about 4.1% of TotalEnergies’ share capital and making EPH one of the company’s largest shareholders upon completion of the transaction.

The transaction will result in the creation of a joint venture owned 50/50 by TotalEnergies and EPH, which will be responsible for the industrial management of the assets and the business development, while each company will market its share of production under a tolling arrangement with the joint venture.

This transaction is fully consistent with TotalEnergies’ Integrated Power strategy and will strengthen its position in European electricity markets by enhancing the complementary relationship between intermittent renewable power generation and flexible power generation (gas-fired plants, batteries). It will allow TotalEnergies to expand its power trading activities across Europe and develop its Clean Firm Power offering to its customers. This will position the company as a key player to meet Europe’s growing data centre demand.

Furthermore, leveraging TotalEnergies’ strong position in supplying LNG to Europe, this transaction enhances the company’s ability to diversify value creation along the gas value chain, particularly between the United States and Europe. The additional net electricity production from the transaction, estimated at 15 TWh/y, will enable the company to capture added value to approximately 2 Mtpa of LNG.

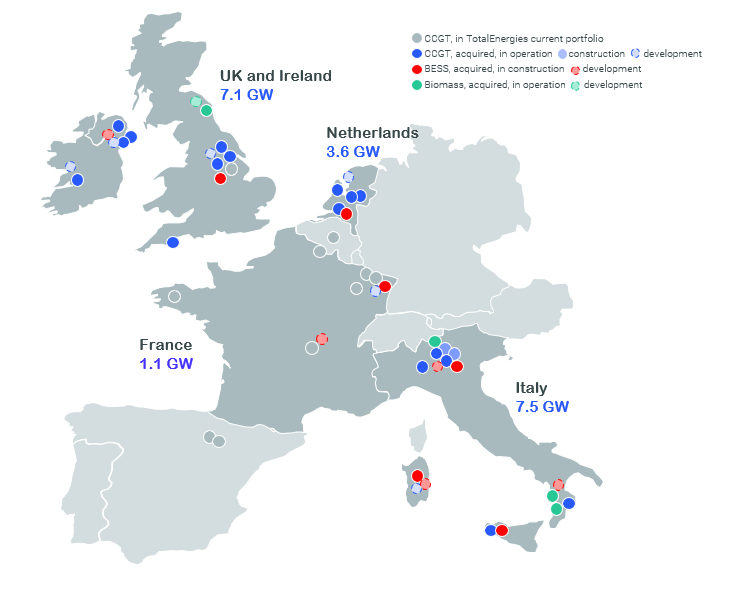

The transaction covers a portfolio of more than 14 GW gross capacity of flexible generation assets in operation or under construction. This primarily includes gas-fired power plants, biomass power plants and battery systems, which benefit from secured capacity revenues representing 40% of the gross margin, allowing TotalEnergies to strengthen its presence in the most profitable European electricity markets.

“This acquisition marks another major milestone in TotalEnergies’ strategy to build an integrated electricity player in Europe. By joining forces with EPH as part of a long-term partnership, we are accelerating the implementation of our Integrated Power strategy and strengthening our ability to provide reliable, competitive, and low-carbon energy to our customers by leveraging the complementarity of our renewable and flexgen portfolio. Given our position as the #1 gas supplier in Europe, this transaction enables us to fully capitalize on gas-to-power integration and create added value for our LNG chain, independently of oil cycles. We are convinced that this partnership will create lasting value for our shareholders and are also pleased to welcome a new long-term European shareholder who is fully committed to TotalEnergies’ transition strategy,” said Patrick Pouyanné, Chairman and CEO of TotalEnergies.

Find more stories like this, here…